Whether you’re a seasoned driver or a new car owner, having a comprehensive car insurance policy is a must. Life on the road can be unpredictable, and accidents happen when least expected. This is where car insurance comes to the rescue, providing the peace of mind you need to navigate the highways and byways confidently.

But what exactly is car insurance, and why is it so important? Car insurance is a type of coverage that protects you financially in case of accidents or damage to your vehicle. It safeguards you against the financial burden that can arise from repairs, medical expenses, or liability claims resulting from accidents.

Just as homeowners insurance protects your most valuable asset, your home, car insurance provides a safety net for your prized possession on wheels. Whether you’re driving a sleek sports car or a reliable family vehicle, having the right car insurance policy can mitigate risks and give you the confidence to hit the road worry-free. So, let’s dive into the world of car insurance, unraveling its benefits and helping you make informed decisions to ensure roadway peace of mind.

Understanding Homeowners Insurance

Homeowners insurance is an essential safeguard for homeowners, providing peace of mind and financial protection against potential risks and damages to their property. This type of insurance not only covers the physical structure of the home but also offers liability coverage and personal property protection.

The primary purpose of homeowners insurance is to protect your investment by offering coverage against various perils, such as fire, theft, vandalism, or natural disasters like floods or earthquakes. In the unfortunate event that your home or belongings are damaged or destroyed, having homeowners insurance can help you recover and rebuild without facing crippling financial burdens.

In addition to protecting the physical structure of your home, this insurance also includes liability coverage. Liability coverage comes into play if someone gets injured on your property and decides to seek compensation for medical expenses or damages. Homeowners insurance can help shoulder these costs and potentially save you from expensive lawsuits and legal proceedings.

Moreover, homeowners insurance extends beyond just your home and liability coverage. It also covers your personal belongings, providing coverage for items such as furniture, appliances, electronics, and clothing, among others. This personal property protection can be particularly valuable in the event of theft, natural disasters, or accidents that cause damage to your belongings.

Understanding the basics of homeowners insurance is crucial for homeowners. By having this coverage, you can ensure that your home, personal belongings, and financial well-being are protected from unexpected incidents or accidents. Remember to carefully review and compare different homeowners insurance policies to find one that best suits your specific needs and offers optimal protection.

Exploring Car Insurance Coverage

In the world of automobile ownership, car insurance plays a vital role in ensuring peace of mind on the road. Understanding the different types of coverage available is crucial when determining the level of protection you need for your vehicle and yourself.

First and foremost, we have homeowners insurance. While homeowners insurance provides coverage for your property, it typically does not extend to your vehicle. That’s where car insurance comes into play. Car insurance is specifically designed to safeguard you financially in the event of an accident, theft, or damage to your vehicle.

When it comes to car insurance, there are various types of coverage you can opt for. The most basic and mandatory form of car insurance is liability coverage, which provides protection against any bodily injury or property damage you may cause to others in an accident. This type of coverage is a legal requirement in many jurisdictions and helps ensure that you have the means to compensate others for any harm you may cause on the road.

Beyond liability coverage, you may also want to consider collision and comprehensive coverage. Collision coverage is meant to cover the cost of repairs or replacement if your vehicle is damaged in a collision with another vehicle or object. On the other hand, comprehensive coverage offers protection against non-collision incidents such as theft, vandalism, or damage caused by natural disasters.

By exploring and understanding the various aspects of car insurance coverage, you can make informed decisions that align with your needs. Remember, having the right car insurance not only provides financial security but also grants you peace of mind as you travel the roadways.

Comparing Auto Insurance Providers

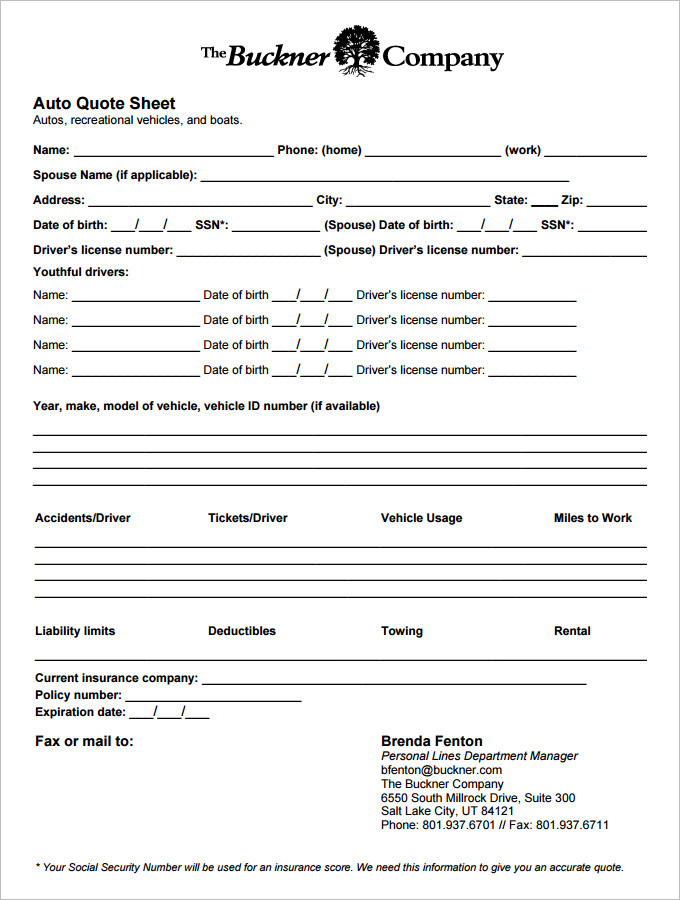

When it comes to choosing the right auto insurance provider, it’s essential to compare your options carefully. Each insurance company has its own unique offerings and coverage options. By taking the time to compare, you can find the provider that best meets your needs and offers you the necessary peace of mind on the road.

bhs insurance

First and foremost, consider the level of coverage each auto insurance provider offers. Make sure they have the necessary options to protect you and your vehicle in different scenarios, such as accidents, theft, or natural disasters. Take note of any additional coverage options they provide, like roadside assistance or rental car reimbursement, as these extras can make a big difference when you need them.

Secondly, take a close look at the premium rates offered by different providers. While cost shouldn’t be the only factor influencing your decision, it’s important to find coverage that fits within your budget. Compare the premiums for similar coverage levels between providers and consider any discounts or incentives they may offer, such as safe driving programs or multi-policy discounts when bundling auto and homeowners insurance.

Finally, don’t forget to research the reputation and customer reviews of each auto insurance provider. Look for feedback from existing customers about the ease of filing claims, the responsiveness of the provider during emergencies, and the overall customer service experience. This will give you valuable insights into how each company treats its policyholders and whether they live up to their promises.

By comparing auto insurance providers based on coverage, premiums, and reputation, you’ll be able to make an informed decision and find the provider that best suits your needs. Remember, the ultimate goal is to have car insurance that provides you with peace of mind on the road, knowing that you’re protected in any situation.