Car insurance is an essential aspect of owning a vehicle, providing financial protection against potential damages and accidents. Whether you are a seasoned driver or a new car owner, understanding the basics of car insurance is crucial. In this ultimate guide, we will delve into the world of car insurance, exploring its importance, components, and factors to consider when selecting a policy.

When it comes to car insurance, the first question that often arises is, "What is car insurance?" Car insurance is a type of contract between an individual and an insurance company, where the individual pays a premium in exchange for coverage in the event of a car-related accident, damage, theft, or other unforeseen incidents. It serves as a safety net, providing financial assistance when unfortunate circumstances occur, allowing drivers to have peace of mind while on the road.

Understanding the ins and outs of car insurance is essential for every vehicle owner. From mandatory policies to optional coverage options, knowing what kind of car insurance suits your needs is crucial. Whether you are seeking liability coverage, comprehensive coverage, or collision coverage, we will explore each type and its specific benefits in detail. Additionally, we will provide practical tips on how to choose the right deductible and the factors that can affect your car insurance rates.

In this comprehensive guide to car insurance, we aim to demystify the complexities surrounding this essential aspect of car ownership. By the end of this article, you will have a clear understanding of the importance of car insurance, the different types of coverage available, and the factors to consider when selecting the right policy for your needs. So, let’s embark on this journey together and equip ourselves with the knowledge to make informed decisions when it comes to car insurance.

Types of Car Insurance Coverage

Car insurance coverage refers to the different types of protection that an insurance policy offers to car owners. Understanding the various types of coverage available is essential when selecting a car insurance policy that suits your needs. Here, we will discuss the three main types of car insurance coverage:

Liability Coverage: Liability coverage is a fundamental component of car insurance that is required in most states. This type of coverage provides financial protection if you cause an accident and are found legally responsible for the resulting injuries or property damage. Liability coverage typically includes two parts – bodily injury liability and property damage liability.

Collision Coverage: Collision coverage helps to cover the costs of repairing or replacing your vehicle if it is damaged in a collision with another vehicle or object. This type of coverage is especially important if you have a newer or more expensive vehicle, as it can help protect your investment. However, it is important to note that collision coverage generally does not cover the full value of your car but rather the cost of repairs or the actual cash value of your vehicle at the time of the accident.

Comprehensive Coverage: Comprehensive coverage provides protection against damage to your vehicle that is not caused by a collision. This includes situations such as theft, vandalism, hail damage, fire, or damage caused by natural disasters. Having comprehensive coverage can give you peace of mind knowing that your car is protected from a wide range of potential risks.

These three types of car insurance coverage are the foundation of any car insurance policy. It is important to carefully review and compare different coverage options to determine the level of protection that best fits your needs and budget. Remember to check your state’s minimum requirements for car insurance and consider additional coverage based on your individual circumstances.

Factors Affecting Car Insurance Premiums

When determining car insurance premiums, several variables come into play. Insurance providers consider various factors to determine the amount you will pay for your car insurance coverage. These factors can significantly impact your premium. Let’s take a closer look at some of these influential elements:

Driving Record: Your driving history plays a crucial role in determining your car insurance premium. Insurance providers assess your record to gauge the risk you pose as a driver. If you have a clean driving record with no accidents or traffic violations, you are likely to receive more favorable rates. On the other hand, if you have a history of accidents or traffic infractions, your premiums may increase.

Vehicle Type: The type of car you drive also affects your insurance premium. Insurance companies take into account the make, model, and age of your vehicle. Generally, newer and more expensive cars tend to have higher premiums. This is because repair costs can be more expensive for these vehicles. Additionally, cars with advanced safety features may qualify for discounts on premiums.

Coverage and Deductible: The coverage and deductible you choose for your car insurance policy will impact your premium as well. A higher level of coverage and lower deductibles typically result in higher premiums. Conversely, opting for lower coverage limits and higher deductibles can help reduce costs. It’s essential to find the right balance between coverage and cost to suit your needs and budget.

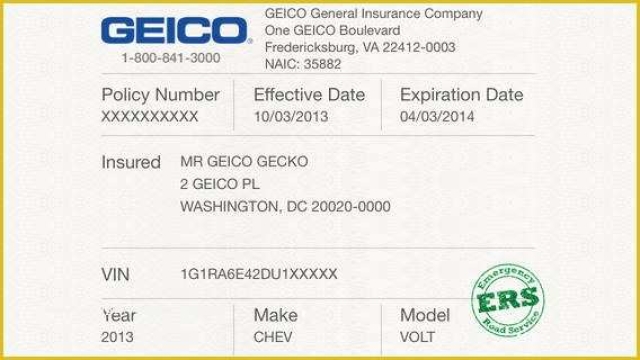

Car Insurance Quotes

As these factors demonstrate, car insurance premiums are not one-size-fits-all. Insurance providers carefully assess multiple variables to determine the cost of your coverage. By understanding these influencing factors, you can make informed decisions about your car insurance to find the most suitable coverage for you.

Tips for Saving on Car Insurance

Comparison Shop: One of the most effective ways to save on car insurance is to shop around and compare quotes from multiple insurance companies. Each company may have different rates and coverage options, so taking the time to research and compare can help you find the best deal.

Increase Your Deductible: Another way to save on car insurance is by increasing your deductible. The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can lower your insurance premiums. However, it’s important to choose a deductible that you can comfortably afford in case of an accident or damage to your vehicle.

Maintain a Good Driving Record: Insurance companies often offer discounts to drivers with a clean driving record. Avoiding accidents, speeding tickets, and other traffic violations can help you save on car insurance. Additionally, some insurance providers offer safe driving programs that monitor your driving habits and reward you with lower premiums for maintaining good driving behavior.

Remember, it’s important to review your car insurance policy regularly and make adjustments when necessary. By following these tips and staying informed about the latest insurance offerings, you can save money on car insurance while still maintaining adequate coverage.